Wealthiest Collectors Face Billions in Losses Amid Stock Market Turmoil

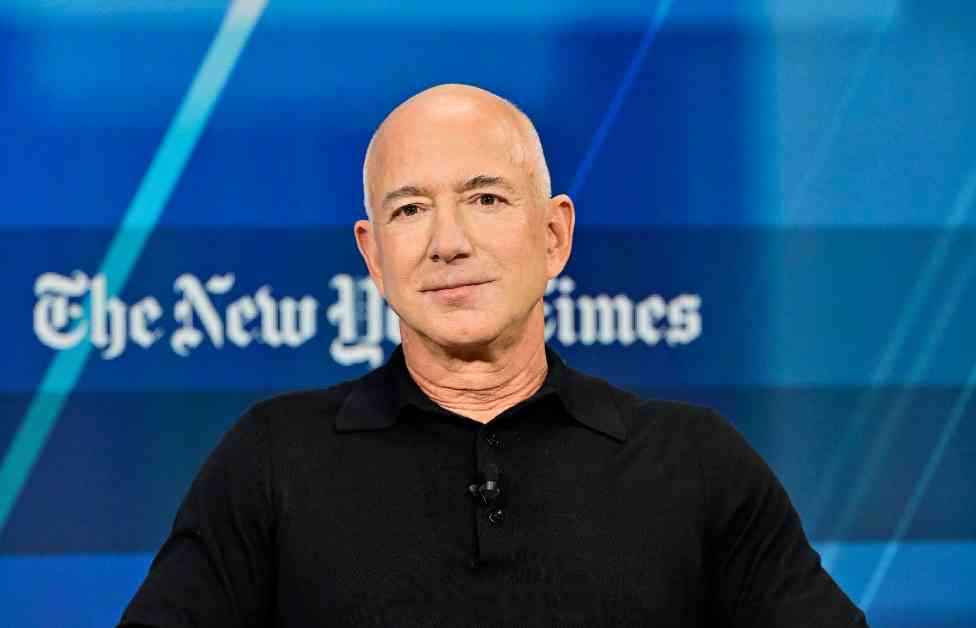

The recent stock market sell-offs on March 7 and March 10 sent shockwaves through the financial world, impacting some of the wealthiest collectors in the art industry. Renowned figures like Jeff Bezos, Bernard Arnault, and Alice Walton found themselves grappling with significant losses as investor concerns over new Trump tariffs and fears of a global recession rattled the markets.

As trading came to a close on Friday, major US indices had plummeted by over 2 percent for the week, with the S&P 500 witnessing a staggering 3.1 percent drop—the most significant fall since September, as reported by NPR. The Wall Street Journal later revealed that on March 10, the Nasdaq Composite suffered a 4 percent decline, adding to the mounting financial woes.

24 out of the 30 Top 200 collectors listed on Bloomberg’s Billionaires Index experienced substantial losses by the end of Monday, following the turbulent market conditions. A comprehensive data analysis by ARTnews unveiled that for 11 of these billionaire art collectors, the two-day downturn translated to a net worth decrease of 3 percent or more.

Unraveling the Impact on Top Collectors

Among the esteemed collectors affected by the market turmoil, Alice Walton stood out with the most significant two-day loss, surpassing $6.5 billion. The beloved founder of the Crystal Bridges Museum of American Art and heiress to the Walmart fortune saw her net worth plummet by 7 percent, landing at $107 billion.

Noteworthy declines were also witnessed by industry giants like Jeff Bezos, whose net worth took a hit of -$5.83 billion, along with Bernard Arnault and Hasso Plattner, who experienced losses exceeding billions of dollars. The financial turbulence wasn’t selective, nudging prominent figures like Alain Wertheimer, Shiv Nadar, Henry Kravis, and Eyal Ofer, whose net worths dipped by over $500 million.

Implications Beyond the Financial Sphere

The cascading effects of the stock market decline extended beyond personal fortunes, raising concerns within the art market. With this year’s challenges including the devastating fires in Los Angeles, ongoing geopolitical tensions, and the repercussions of Trump’s tariffs on imports from China, Hong Kong, Canada, and Mexico, the industry faces an uncertain road ahead.

While current import tariffs have spared photographs and artworks from certain countries, the exemption remains at the mercy of US Customs and Border Patrol officials. Canada’s retaliatory tariffs on various goods, including art-related merchandise, pose further challenges for art institutions, auction houses, and galleries in New York.

President Donald Trump’s recent announcements regarding tariff escalations on steel, aluminum, and potential retaliatory measures against Canada have only added to the prevailing climate of uncertainty. His suggestion of incorporating Canada as the 51st state sparked widespread debate and skepticism among Canadians, underscoring the complex dynamics at play in the current economic landscape.

President Trump’s proposed tariff hikes and diplomatic rhetoric have left many art professionals and industry stakeholders grappling with mounting costs and operational challenges. As the art world navigates these turbulent waters, the resilience and adaptability of collectors and institutions will be put to the test in the face of ongoing economic and geopolitical shifts.

President Trump’s unconventional approach to trade policy and international relations underscores the far-reaching impact of decisions made at the highest levels of government, leaving both art and finance communities on edge. The evolving landscape of global trade dynamics will continue to shape the future of the art market, requiring stakeholders to remain vigilant and adaptable in the face of uncertainty.